Our company formation advisors in Bahrain help clients open the most appropriate legal structure for their business projects in this country. Our services include company formation and also corporate advisory services or corporate secretarial services, among others.

| Quick Facts | |

|---|---|

| Types of companies |

Limited Liability Company (restrictions apply in certain industries) Single-Person Limited Liability Company Free Zone Company Shareholding Company (the equivalent of the public company) |

|

Minimum share capital for LTD Company |

USD2,660 paid at once |

|

Minimum number of shareholders for Limited Company |

1 |

| Time frame for the incorporation (approx.) |

6 weeks |

| Corporate tax rate |

The standard rate is 0%, however companies in the oil, gas and other related sectors are subject to a 46% corporate tax. |

| Dividend tax rate |

No withholding tax on dividend payments |

| VAT rate |

The standard rate is 5%. A 0% rate applies to certain goods. |

| Number of double taxation treaties (approx.) | 45 |

| Do you supply a registered address? | Yes |

| Local director required | Yes |

| Annual meeting required | Yes. Electronic conference meetings are also allowed for private companies. |

| Redomiciliation permitted | No |

| Electronic signature | Yes |

| Is accounting/annual return required? | Yes |

| Foreign-ownership allowed | Yes, except for industries like trade, media,retail where a Bahraini partner is required. |

| Any tax exemptions available? | No corporate and dividend taxes.

|

| Tax incentives |

No |

What is the main business structure in Bahrain?

The main business structure used by foreign entrepreneurs in Bahrain is the LLC (limited liability company). According to the Commercial Companies Law of 2001, there are eight types of companies which can be set up, depending, among other factors, on the number of investors and the activity of the company. These business vehicles can be owned entirely by foreign citizens. There are, though, certain restricted sectors in which a company entirely owned by foreigners cannot operate in.

The only legal structures in Bahrain which can do business in the sectors of banking and insurance are the public and closed joint stock companies and the foreign branch companies.

Our immigration lawyers in Bahrain can advise foreign investors on the main ways for immigrationg to this country after opening a company in Bahrain. Support for the processing of Bahrain ID cards and driving licenses, as well as work permits and visas, can be offered by our local specialists in immigration to Bahrain. When translations and notarization are necessary for local approvals or paperwork involving local government agencies, our PRO services can also be employed.

Types of LLCs in Bahrain

Foreign citizens can set up three different types of limited liability companies (LLCs) in Bahrain:

• The single person company (SPC) is a limited liability company owned by only one proprietor;

• The company with limited liability (WLL) needs at least two shareholders and two directors in order to be set up. Additionally, a local manager is needed. This person generally is the company secretary;

• Bahrain shareholding company (BSC), similarly to a WLL, requires at least two shareholders and directors, together with a resident manager. This structure is ideal for a large number of entrepreneurs for large projects.

All three types of LLCs in Bahrain confer limited liability to their shareholders and can be owned 100% by foreign citizens interested in immigration to Bahrain.

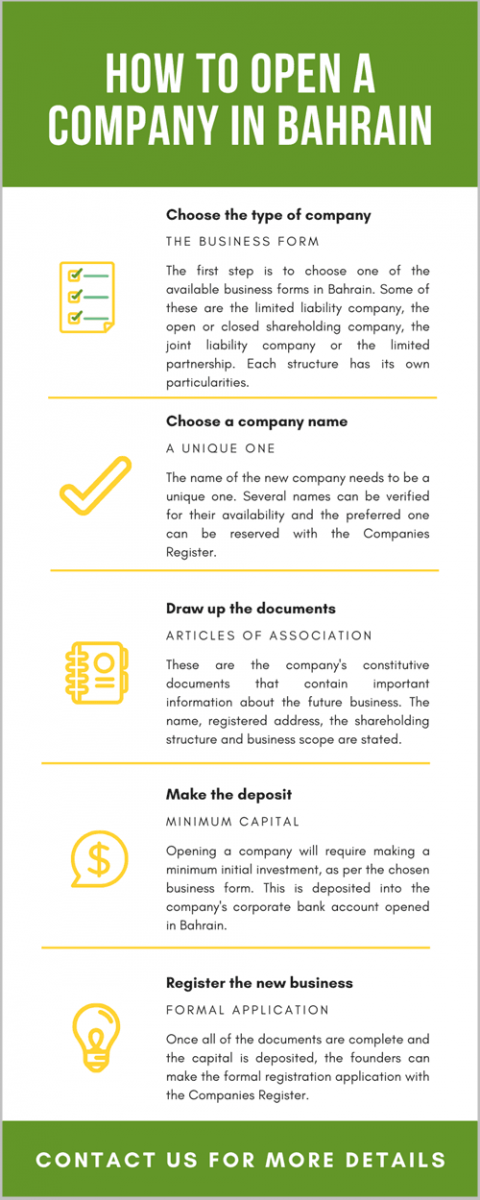

Steps for company formation in Bahrain

The steps for opening a company in Bahrain are as follows:

- Choosing a legal form: investors must choose a type of company from those described in the Commercial Companies Law of Bahrain.

- Choosing a company name: for this initial step, investors are advised to pick several names; if a name is available, it will be reserved with the Companies Register.

- Drawing up the company documents: the Articles of Association and the By-Laws of the company need to be prepared and included in the registration file.

- Making the capital deposit: a certificate is issued when the capital is deposited; in-kind contributions are to be audited.

- Filing for electronic registration: once all the documents are gathered, investors can submit the application for registration electronically; copies of the personal identification documents of the founders will be required and when the partners are other corporations, they will need to provide copies of the Articles of Association.

Apart from these steps, investors will also need to take into consideration the costs of opening a company in Bahrain. These costs are highlighted below.

The Company Register in Bahrain functions under the Ministry of Industry, Commerce, and Tourism and it is the authority in charge of receiving company registration applications, processing them and issuing the corresponding certificates to businesses. Investors who wish to perform certain company changes will also submit their requests to this registry as well as those companies that enter into bankruptcy. Additional services will include printing company information extracts or stamping certificates.

Entrepreneurs who are interested in company formation in Bahrain will need to comply with the mandatory requirements for company registration and for this purpose one of our agents can provide specialized services, according to company type.

We also have a team of immigration lawyers in Bahrain who can help foreign investors move here. The Golden Residency Visa program was introduced by the Kingdom of Bahrain in February 2022, in an effort to draw in overseas investors. Bahrain seeks to draw talents in order to assure its continued development, in addition to the Interior Ministry’s efforts to attract investors. This is also one of the simplest ways to acquire a residence permit in Bahrain.

What is the Commercial Registers System in Bahrain (SIJILAT)?

The Commercial Registers System or SIJILAT was launched in an effort to create an especially efficient electronic system for company registration in Bahrain that is also connected with the licensing system. It links the electronic systems used by all official authorities that issue specific licenses and approvals and thus manages to greatly simplify the entire company registration and licensing process.

The Commercial Registers Systems is a unified single platform for businesses that offers complete services to company owners who need to register a new company or change information about an existing one and also to individuals who need to perform a comprehensive business search.

What are the main features and services included in the SIJILAT?

The Commercial Registers System offers access to the e-application, e-submission, e-booking of commercial names as well as the e-certificate services and e-verification of business transactions. It clearly separates the licensing process for companies from the registration process, both important steps for those who set up a company in Bahrain. For the licensing services, it offers a direct link to the relevant licensing authorities and thus greatly streamlines the entire process.

Access to the registry is possible through a specially created account and once this step is complete, entrepreneurs will be able to apply for commercial registration, make changes to an existing registered company or renew the business registration certificate, as needed. They can be helped by our experienced agents for all the stages of opening a company in Bahrain.

What are the main requirements for registration with the SIJILAT?

The electronic company registration in Bahrain is a simple process and in order to register a new legal entity, investors will need to follow five basic steps. These are:

- Submit the application: this is done electronically in person or through a professional intermediary, such as our agents who specialize in company formation in Bahrain;

- Obtain the clearance: this applies to foreign investors and it involves obtaining a security clearance; we can offer you more information on this step;

- Attach the company documents: these include the Articles of Association for the new business entity, the fundamental incorporation documents that state the scope and type of business as well as other details.

- Attach the capital deposit proof: this is a certificate that is issued once the capital deposit has been made;

- Attach other documents: when the company’s capital is in-kind, the founders will also need to attach the assessment certificate from an auditor or expert; other documents may include those specified by other authorities for the purpose of obtaining special permits and licenses.

One of our agents who specialize in company formation in Bahrain can help investors throughout the company registration process. The system is efficient and allows for a streamlined application for registration and licensing, however, entrepreneurs can use specialized guidance especially in those cases in which the company is subject to additional licensing and control. In most cases, the applicants will also need to upload proof of their academic qualifications when making the electronic company registration submission. The documents attached together with the application should not exceed a certain size and the process may differ in case of branches. This is especially important in case of branches with irregularities and we recommend reaching out to one of our agents when the registration of a branch is difficult.

The commercial registration department for commercial companies in Bahrain submits the applications for approval with the Ministry of Industry, Commerce and Tourism, where the application is reviewed in order to confirm that the business is compliant.

If you have more questions about setting up a company and immigration in Bahrain, please feel free to get in touch with us. If you want to open a company in another country, such as Qatar, we can help you get in touch with our local partners. Our team of lawyers in Bahrain can manage a wide range of legal claims and can come up with a strategy that is tailored to your desired outcomes in a cost-effective way. We provide clients with advice on a full range of dispute resolution options, including litigation, arbitration, and cross-border disputes, in accordance with international guidelines.