Shelf companies, also known as ready-made companies, are legal entities that were registered in previous years and have stayed inactive. When an investor decides to acquire a shelf company in Bahrain, the time needed for purchasing it is much shorter than if they were to set up a new legal entity. Also, such a company enables its foreign owners to avoid a number of inconveniences, such as the ones related to immigration to Bahrain. You can rely on our local specialists if you want to buy a shelf company in Bahrain.

| Quick Facts | |

|---|---|

| Legal entities available for shelf company |

– limited liability company, – shareholding company |

|

Time required for purchasing the company |

A few days |

|

Types of features it includes (corporate bank account, VAT number, etc) |

– trading name, – registered address, – director, – company bank account, – tax number |

| The advantages of a shelf company |

– simple acquisition, – possibility to use it for various activities, – full foreign ownership

|

| Appointing new directors |

Yes |

| Capital increase allowed |

Yes |

| Certificate of no commercial activities |

Yes |

| Modify the objects of activity | Yes |

| Participants in the purchase procedure | Buyer or representative and seller |

| The cost of buying a shelf company | The cost depends on the type of company purchased and its age. |

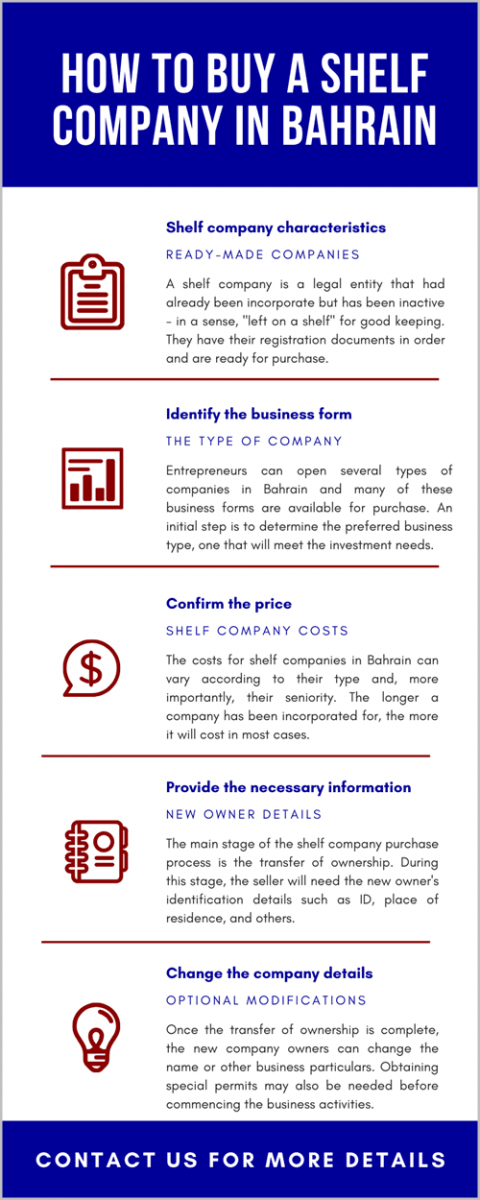

How to buy a shelf company in Bahrain

In Bahrain, both natural persons and companies may purchase shelf companies. When purchasing an aged company, the buyer must prepare identification papers such as a passport or identity card, or a certificate of registration if the company wants to purchase a ready-made entity.

All the legal paperwork must be signed at a notary office by the buyer and seller for the transaction to be completed. The new company owner and other shareholders will be able to change the company name and other information in the Articles of Association after the selling process is complete.

If necessary, after the contract is signed, our company registration agents in Bahrain will modify the Articles of Association and submit them, along with the other relevant documents, to the Companies Register.

Deciding to open a company in Bahrain is one of the best decision a businessperson can make. The market is maturing and opening to new industries and the incorporation procedure has been simplified a lot. Moreover, you can rely on our local specialists who are at your disposal with a wide range of services, so that you can start running your business in the shortest time.

You can also ask our local specialists for advice if you’re looking for a shelf company for sale in Bahrain.

Less documentation required

One of the main advantages of acquiring a Bahraini shelf company is that it comes with most of the documents drafted, so you will not need to complete too many formalities.

Shelf companies will usually come with:

- the Memorandum and Articles of Association, which may be updated;

- the registered address, which may or may not be changed;

- local bank account;

- the Tax Identification Number issued by the Revenue Agency;

- the Certificate of Registration.

There are various modifications that can be made, but some of them are required. For instance, the Articles of Association must contain the names of the new shareholders.

We can assist you in finding a shelf company for sale that best suits your needs if you’re looking for one.

Most common forms of shelf companies in Bahrain

According to the regulations on issuance of the residence permit for Bahrain, it is now possible to move here through investor visas. This type of permit allows foreign entrepreneurs to have their own companies. So, if you are interested in this option of acquiring a shelf company, do not hesitate to contact our local specialists.

These companies can be in any form and are valid for one year, at which time the appropriate approvals and licenses have to be obtained.

A shelf company in Bahrain can be sold, however, its operations have to be approved by the government.

The most common types of legal entities in Bahrain are the closed joint stock company and the limited liability company.

For setting up such a company in Bahrain, the following documents have to be submitted:

- an online application;

- a pre-approval from the appropriate government ministries, which is effectuated through an online portal called Sijilat;

- the draft memorandum or the Articles of Association;

- the in-kind capital evaluation, which is done by an auditor, if necessary;

- other documents – our company formation advisors in Bahrain can offer more details on what these other documents consist of.

You can also rely on our immigration specialists in Bahrain if you want to move here by acquiring such a company through an investor visa. The investor work permit also entitles the holder to serve as the sponsor for family reunion visas for those interested in immigration to Bahrain and who want to bring their relatives. Our local advisors are at the service of foreign citizens who choose to take this step and apply for residency here.

Our lawyers in Bahrain can also advise with regard to financing, projects, and real estate investments. Our job entails assisting property owners and investors with the development of various types of real estate property, resolving lease disputes, and streamlining the process of acquiring a property as a foreign citizen or investor.

The shelf company has various uses

A shelf company can be used in various ways, but it is typically utilized to carry out business operations.

A ready-made business in Bahrain can also be used for the following things:

- as a vehicle for obtaining loans from Bahraini banks (some banks require an established reputation and history),

- it can be used for private-public partnerships with the local authorities for joint projects,

- it can be used for joint venture agreements with other private businesses in Bahrain,

- it can also be used for relocation by incorporating the history of an existing business into the shelf company bought to operate in Bahrain.

Our advisors can provide you with details on the procedures you must follow when purchasing a shelf company if you are interested in one that is up for sale in Bahrain. We can also assist you in verifying the chosen entity.

We are also at your service should you want to register a new company in Bahrain.

Advantages of shelf companies in Bahrain

Shelf companies in Bahrain bring their investors’ numerous advantages, such as:

- They save time since their purchase procedure takes less time than if they decided to set up a new company, especially when looking for quick immigration to Bahrain;

- They enable easier access to bank credits;

- Since they have a history, they are able to provide greater credibility to local partners, investors, and clients;

- They confer the opportunity to be able to bid for contracts.

The shelf company may need to be registered for VAT purposes in Bahrain. One of our agents can provide more details.

You can also watch our video below:

The ready-made company in Bahrain from a taxation point of view

Any investor who buys an existing business can benefit from the double taxation agreements Bahrain has signed (approximately 45 treaties), as well as the country’s tax laws which imply no corporate taxes for most companies.

As a foreign investor you can use an accounting specialist to oversee all aspects of your new company’s finances, and our accountants in Bahrain can assist in such matters.

Another important aspect to consider is the introduction of the value added tax not long ago. Here are the main highlights of the VAT and VAT registration in Bahrain:

- the shelf company is treated as a domestic enterprise from this point of view;

- the company must be registered for VAT when reaching a turnover of BHD 37,500;

- the standard rate of this tax is 10%, however, there is also a 0% rate for certain products;

- VAT payments must be made quarterly for small businesses, and monthly for those with annual supplies of more than BHD 3 million.

It is important to be aware that people who buy shelf companies can also benefit from government tax incentives.

If you want to set up a shelf company in Bahrain, or if you need any company registration advice, please feel free to contact our friendly staff who also has immigration lawyers in Bahrain ready to guide you in moving here.