The limited liability company is one of the most popular business forms in Bahrain. The fact that it requires no minimum share capital, combined with the investor’s limited liability, make it an advantageous business form for local and foreign investors alike.

In order to set up an LLC in Bahrain, investors are required to observe the minimum number of partners, two investors, as well as the conditions for the minimum value of shares.

The LLC in Bahrain cannot issue public shares, like the public shareholding company (BSC), however, it is recommended to those investors interested in opening a small or medium-sized business and enjoy the limited liability, as opposed to the conditions for opening a single person company (where the liability is unlimited).

Company formation in Bahrain is subject to a set of rules, set forth by the Ministry of Industry, Commerce and Tourism and reflected in the relevant corporate and tax laws. One of our agents who specialize in company registration can give investors complete details about the legal requirements for the LLC and any other types of companies. At the same time, you can rely on our immigration lawyers in Bahrain for assistance in moving here.

The main characteristics of the Bahrain LLC

The limited liability company, LLC or WLL, is one of the main types of business forms that can be incorporated in Bahrain. Shareholders have limited liability, up to the amount of their investment in the legal entity.

The main characteristics of the LLC are the following:

- • The minimum number of partners: at least two shareholders are needed to open this business form; otherwise, the company is converted into a single person company.

- • The maximum number of partners: a maximum number of shareholders does apply, and this limit is 50 partners.

- • Minimum capital: there is no mandatory minimum share capital for the LLC in Bahrain.

- • Shares: the capital is divided into equal shares, with a value of at least 50 BD for each share.

- • Office: the LLC in Bahrain must maintain a local office; virtual office options are available and can be advantageous.

- • Taxation: companies in Bahrain are only taxed when they are involved in the extraction production and refining of oil, gas, and petroleum.

The transfer of shares is restricted in the case of the LLC, however, it is possible between partners under special conditions set forth in the company’s Memorandum and Articles of Association. One of our agents who specialize in company formation in Bahrain can give you more details about the particularities of the LLC and the other available options, including changing the business form. Regarding this aspect, investors should know that if the number of partners falls under two for the LLC, it is automatically converted into a single person company. This can be prevented if the company completes the quorum within 30 days after the single shareholder has acquired all of the company shares. Through our immigration lawyers in Bahrain, you can also apply for various types of residence permits. Residency in Bahrain can be divided into short-term for a few years and permanent which comes with various requirements. However, to qualify for a permanent resident card, you must first obtain a temporary one. Feel free to address our local specialists for detailed information on the best way to secure such a visa based on your particular situation and desires.

In order to incorporate a company in Bahrain, there are a few requirements to consider. Prepare the necessary documents first. It will be required to have your documentation prepared in order to obtain approvals and continue the process. However, you can get in touch with us so we can help you start a business, as soon as possible.

The steps for LLC set up in Bahrain in 2024

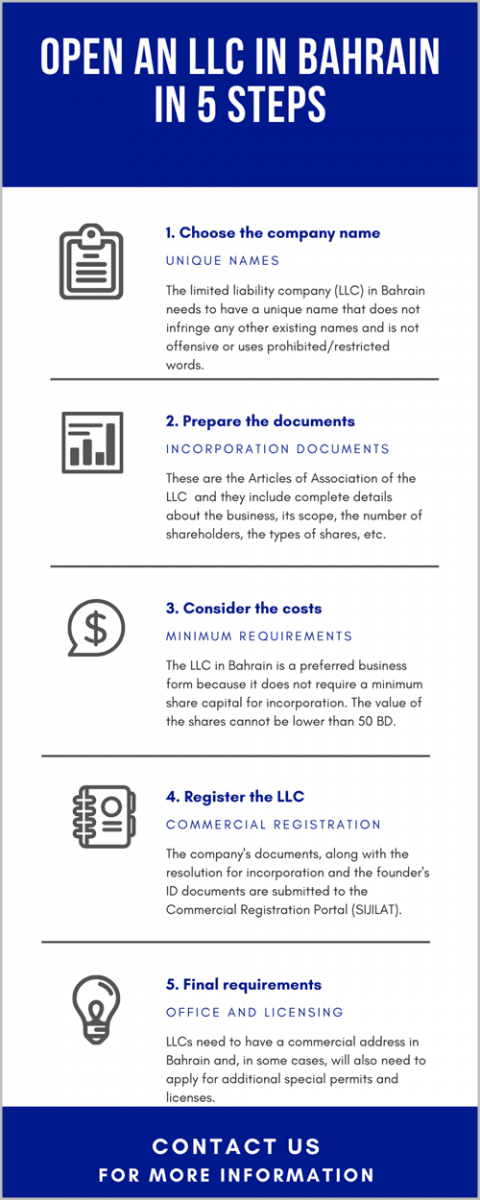

Below, our team of agents who specialize in company registration in Bahrain lists the most important steps, the ones that are mandatory for registering a limited liability company in the Kingdom of Bahrain in 2024. These are:

- Choosing the company name: the name of the new LLC needs to be in line with the local guidelines and must be a unique one.

- Company documents: preparing the company’s Articles of Association and Memorandum can be accomplished with the help of one of our agents.

- Resolution: the Board of Directors draws up a resolution to establish the company in the Kingdom of Bahrain.

- Submission: the company’s documents, the resolution as well as copies of the founder’s ID cards and other documents are submitted for registration.

- Office arrangements: the LLC needs to have a commercial address in Bahrain and proof of the leasing agreement should be provided upon incorporation.

The company’s capital is deposited in a bank account. For this step, the attendance of the investors is required for the purpose of obtaining an authorized signature. Companies in Bahrain may be required to obtain special approvals or permits prior to registration. This requirement is applicable in some business fields and we recommend getting in touch with one of our agents before commending the registration procedure. This way, you can have all of the needed information about opening an LLC in 2024 in your chosen area of business. We can also provide information on the current VAT registration requirements.

A number of business entities are available for company formation in Bahrain. The right choice depends on the nature and size of the business, the available capital as well as the plans for expansion.

If you need to set up a company in another country, such as Saudi Arabia, we can put you in touch with our local partners.

You can also rely on our lawyers in Bahrain if you are interested in immigration to Bahrain here by starting a business.

Why open an LLC in Bahrain in 2024

First of all, the creation of a limited liability company in 2024 is the same as it was a few years ago, as the Bahrain legislation has not changed. This is why it is quite easy to register. Moreover, the LLC is one of the most employed types of entities in this country. It can also be used for immigration to Bahrain.

At the level of 2024, the registration procedure of a Bahrain-based LLC happens in a matter of days, thus the investor will be able to start the activities rather quick.

Foreign investors who want to open limited liability companies in Bahrain in 2024 can benefit from the entire support of our agents. One of the reasons to create an LLC in Bahrain is also the economic growth that is expected this year.

A 1.8% real GDP increase is predicted for Bahrain in 2024, which would rank the country second in the GCC in terms of growth in 2024, behind the UAE. This relative outperformance can be largely attributed to Bahrain’s oil sector, which accounts for less than 5% of total output, the smallest proportional share in the block. Furthermore, the oil sector will once again be the main focus for the outlook for regional growth, with lower oil output expected to occur for a second year in a row due to the ongoing OPEC+ production curbs. It is also forecasted for Bahrain’s real GDP growth to pick up speed to 3.1% by 2025.

For complete details about how to set up an LLC in Bahrain, or any other business form, please contact our company formation agents. We can also help you with company formation in Sweden.